Daily Metals Mining Rundown - Free (Intraday ASX)

Includes: metals pricing, peer group median price performance, peer group median valuations, and list of top and bottom 40 daily performing stocks showing associated peer groups based on our database of 450+ mining stocks, but excludes the lists of individual stocks making up each peer group, their price performances, and their ranked valuation information by market cap/unit resource and by P/NAV. Published and distributed daily (either before, during, or after ASX trading hours), 3-5 days per week. For legal disclosures, visit www.hostrockcapital.com/disclosures.

Archive

Daily Metals Mining Rundown for 13 Feb 2026 (after-market ASX)

Silver price tanked -7% to under $78/oz over past ~26 hrs, alongside gold, palladium, platinum, nickel, and copper falling -2 to 5%, which led to silver mining stocks falling ~8% or more and most other metals miners falling multiple percent or more.

Daily Metals Mining Rundown for 12 Feb 2026 (after-market ASX)

PGM and silver prices dropped -2 to 4% over past ~24 hrs, while other metal prices were largely flat; Mining stocks went mostly sideways in the session across the metals complex, with larger cap base metals miners standing out slightly, alongside the full spectrum of gold and silver stocks.

Daily Metals Mining Rundown for 11 Feb 2026 (after-market ASX)

Most metal prices rose over past ~24hrs, led by platinum, nickel and silver gaining +4-5%, followed by copper, palladium, uranium, lithium, and gold rising 1-3%; Mining stocks were relatively flat in last session, except for PGM producers which stood out and mostly gained a few percent; Covered announcements includes a PEA by 1911 Gold Corp. for project in Manitoba.

Daily Metals Mining Rundown for 10 Feb 2026 (after-market ASX)

PGM prices bounced thru NA trading yesterday and ASX trading today, rising +1.9% and +1.5% to nearly US$1,750/oz Pd and $2,100/oz Pt, while gold and silver prices continued to rise gently (to $5,050 and $82/oz) after also jumping over the weekend; Posted uranium pricing also inched +1% higher today, to over $86/lb U3O8; Metals mining stocks are back in the green, mostly rising multiple percent over latest session - led by silver, gold, and uranium stocks which mostly rose ~5% or more.

Daily Metals Mining Rundown for 9 Feb 2026 (after-market ASX)

Silver price JUMPED +4% over the weekend and thru ASX trading - back over $80/oz, with gold inching +1% - back above $5,000/oz; PGM prices dipped -2% while other metal prices were largely flat; Strong start to the week for ASX mining stocks, across the metals spectrum.

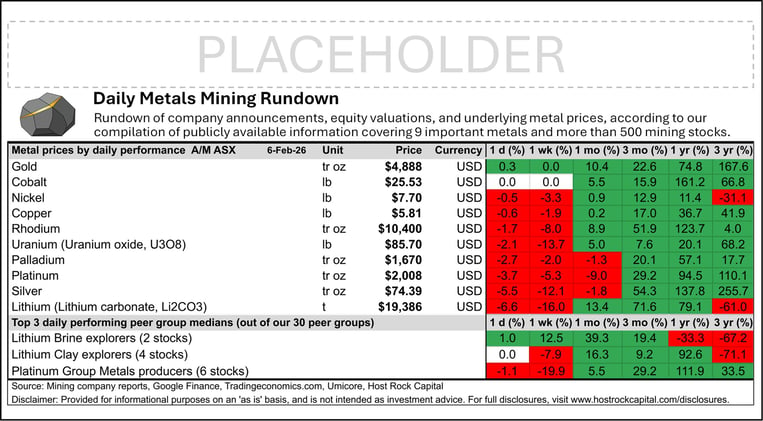

Daily Metals Mining Rundown for 6 Feb 2026 (after-market ASX)

Most metal prices continued falling over past ~24hrs, led by lithium falling -7%, silver down -5.5%, and platinum and palladium dropping -3-4%; Gold price remained relatively flat; Mining stocks continued their downtrend, with most dropping -5% or more, and most silver and uranium stocks dropping more steeply by 8-10% or more; Covered announcements include completion of Probe Gold acquisition by Fresnillo from a few weeks ago.

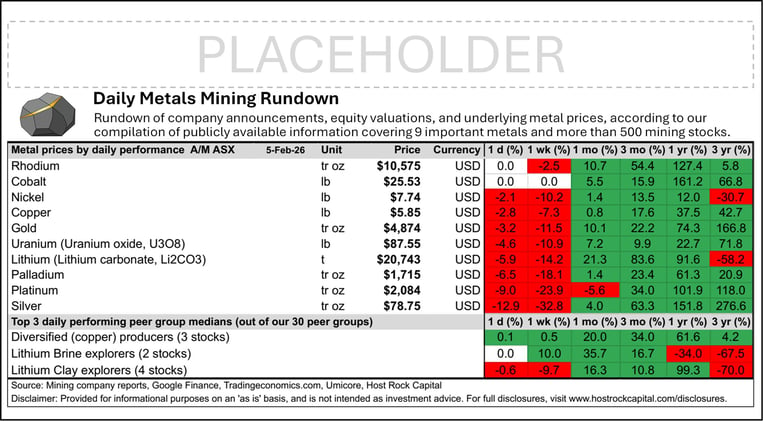

Daily Metals Mining Rundown for 5 Feb 2026 (after-market ASX)

Metal prices TUMBLED over past ~24hrs of trading, led by silver, platinum, and palladium falling -13%, -9%, and -6.5% - with gold slipping a lesser -3% to $4,875/oz; Most mining stocks also fell a few percent or more in last session, except uranium miners which slipped 7-8% or more; Covered announcements include acquisition of Foran Mining by Eldorado Gold.

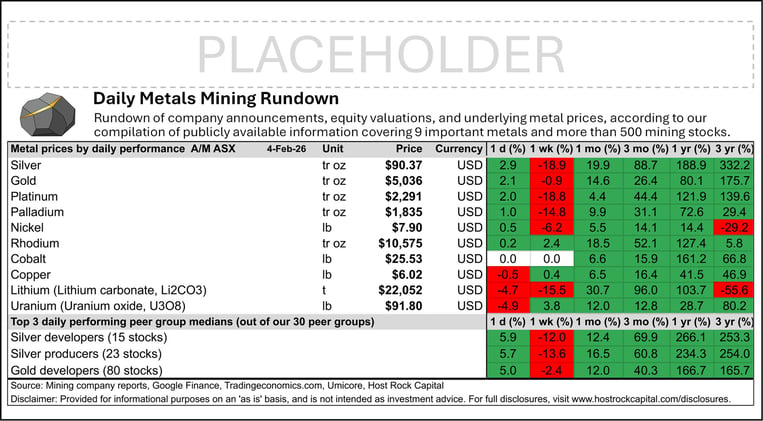

Daily Metals Mining Rundown for 4 Feb 2026 (after-market ASX)

Silver and gold prices notched +2% and +3% higher over past ~21 hrs, with silver now back above $90/oz and gold above $5,000/oz; PGMs and nickel prices are also in the green; Most metals mining stocks are up slightly, with silver, gold, uranium, and copper miners standing out and mostly rising ~4-5% or more.

Daily Metals Mining Rundown for 2 Feb 2026 (after-market ASX)

Palladium price bounced/rose +2% over the weekend (but remains down -14% over past week after Friday's crash in precious metals prices), while other metal prices slipped further including platinum -0.5%, silver -1%, copper -1%, nickel -2%, and gold -2%; Most ASX miners cratered today - syncing with the blood bath experienced by the sector during North American trading on Friday.

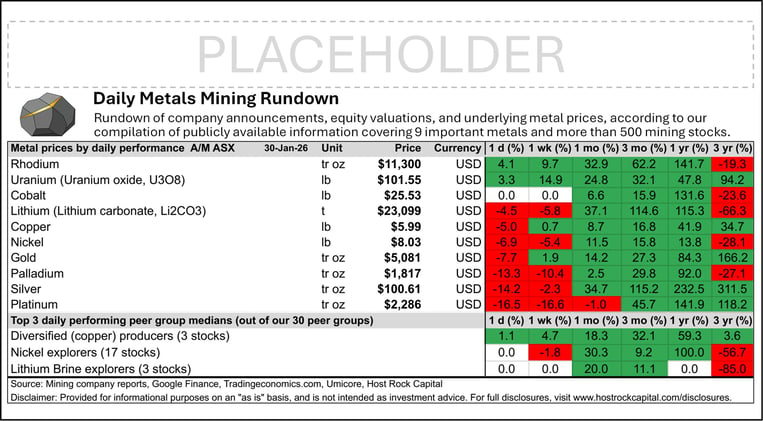

Daily Metals Mining Rundown for 30 Jan 2026 (after-market ASX)

Precious metals and base metals prices suffered sharp corrections over the past ~24hrs, with gold and silver dropping -8% and -14% to below $5,100/oz Au and to just above $100/oz Ag, and with copper & nickel falling -5% to $6/lb Cu and -7% to $8/lb N; This led to most mining stocks trading down multiple percent during the past session; Meanwhile, rhodium and uranium prices gained +4% and +3%, with uranium breaching the $100/lb U3O8 mark.

Daily Metals Mining Rundown for 29 Jan 2026 (after-market ASX)

Metal prices surged again over past ~22hrs, with the gold price breaching the $5,500/oz level after rising +4% to $5,505/oz, outperformed by uranium, copper, and palladium rising +8%, +6.5%, and +5% to $98.30/lb U3O8, $6.30/lb Cu, and $2,094/oz Pd, with nickel platinum, silver, and rhodium also rising +3-4%; Uranium stocks outperformed among metals miners over the trading session, while gold and copper miners also mostly inched higher and lithium stocks mostly fell sharply by multiple percent.

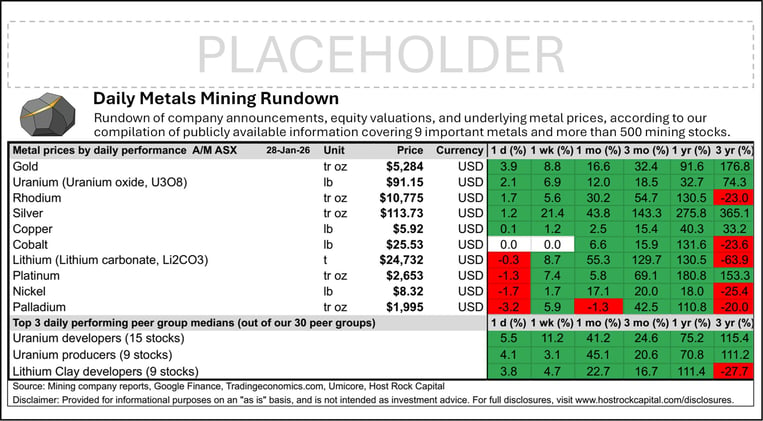

Daily Metals Mining Rundown for 28 Jan 2026 (after-market ASX)

The gold price ripped again over past ~24 hours, marching up +4% to fresh highs approaching $5,300/oz, while uranium, rhodium, and silver prices also inched higher; Larger cap uranium mining stocks stood out among metals miners over the past session, while gold and copper stocks also rose gently; Covered announcement includes resource update for Greater Duchess project in Australia by Carnaby Resources.